Rexas Finance aims to drive the tokenization of real-world assets (RWAs), marking a new chapter in the convergence of blockchain and traditional finance. Could it redefine the investment landscape? It’s a topic worthy of deeper exploration.

Rexas Finance: Building a Bridge for RWA Tokenization

Rexas Finance is a blockchain-based platform dedicated to the tokenization of real-world assets. More than just a technological solution, it represents a shift in financial thinking—leveraging the transparency, efficiency, and divisibility of blockchain to dismantle traditional barriers and broaden access to asset allocation. The platform provides tools that enable the tokenization and digital management of assets such as real estate and precious metals, making them tradable on-chain.

The Core Value of RWA Tokenization: Unlocking Liquidity and Accessibility

At its heart, RWA tokenization seeks to enhance liquidity and accessibility. Traditionally, assets like real estate are illiquid and require significant capital to invest. By breaking these assets into blockchain-based tokens, Rexas Finance lowers the investment threshold and allows for fractional ownership and trading, drastically improving liquidity.

Transparent and Secure: The Technical Architecture of Rexas Finance

Rexas Finance is built on a secure blockchain infrastructure and leverages smart contracts to automate asset management processes. These contracts handle functions like dividend distribution and rental income allocation transparently and efficiently, reducing the need for manual intervention and minimizing operational risk.

RWA Tokenization: The Next Growth Engine for Blockchain?

Many experts view RWA tokenization as the blockchain industry’s next major growth catalyst. As the DeFi (Decentralized Finance) ecosystem matures, the demand for integrating traditional financial assets is surging. RWA tokenization bridges this gap, injecting new utility and capital into the DeFi space.

Competitive Landscape: Opportunities and Challenges for Rexas Finance

The RWA tokenization space is becoming increasingly competitive, with key players such as Centrifuge, Maple Finance, and Goldfinch leading the charge. For Rexas Finance to stand out, it must offer distinct advantages.

| Project | Core Business | Strengths | Challenges |

|---|---|---|---|

| Centrifuge | RWA-backed lending | First-mover advantage, mature ecosystem | Regulatory compliance, asset risk |

| Maple Finance | Institutional lending | Strong ties to TradFi, large capital pools | Centralized dependencies, transparency |

| Goldfinch | Uncollateralized loans | Innovative credit model, low collateral | High risk, potential for bad debt |

| Rexas Finance | Diverse RWA tokenization | Robust tools, broad asset coverage | Low brand awareness, needs ecosystem growth |

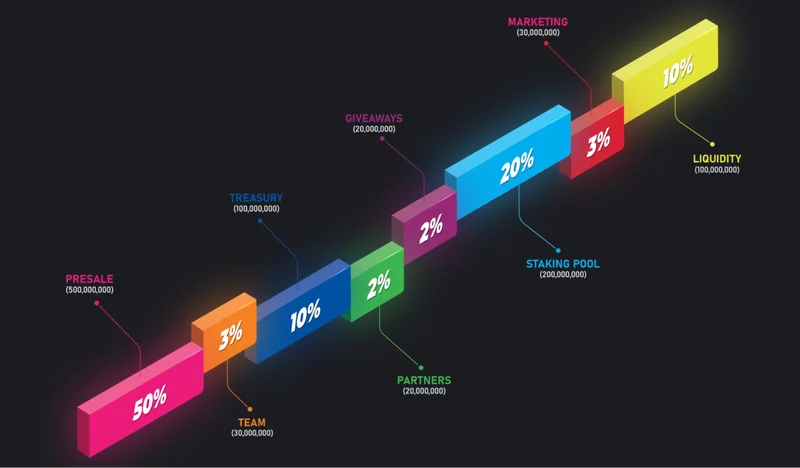

Tokenomics: Incentives and Governance

Rexas Finance relies on a well-designed token economy to incentivize participation and govern the platform. Token rewards encourage users to tokenize and trade assets, while governance mechanisms aim to foster community engagement and ensure long-term sustainability.

Key Challenges for RWA Tokenization: Regulation, Security, and Trust

Despite its potential, RWA tokenization faces critical challenges—chief among them being regulatory compliance, asset security, and building user trust.

Regulatory Complexity Across Jurisdictions

Since RWAs are subject to various legal frameworks, global compliance is a major hurdle. Rexas Finance must work closely with regulators to align with local laws and ensure smooth operations.

Smart Contract Vulnerabilities and Custodial Risks

Security is another major concern. Vulnerabilities in smart contracts or poor custodial practices can put user assets at risk. Rexas Finance must undergo rigorous code audits and implement secure custodial solutions to safeguard investments.

Establishing Trust Through Transparency

To gain user trust, Rexas Finance must provide transparent asset information, including ownership details, valuations, and risk disclosures—empowering users to make informed decisions.

Rexas Finance’s Long-Term Potential: Reinventing Financial Infrastructure

In the long run, Rexas Finance has the potential to redefine how financial infrastructure operates. By tokenizing real-world assets, the platform could lower transaction costs, enhance efficiency, and democratize access to investment opportunities. If it successfully overcomes regulatory, security, and trust challenges, Rexas Finance may emerge as a key player in the RWA space.

Broader Impacts: Implications for Staking and Decentralized Computing

The success of Rexas Finance could influence adjacent sectors like blockchain staking and decentralized compute markets. Tokenized RWAs might serve as new forms of collateral in staking systems, while also creating asset-backed computing models to improve resource utilization.

Looking Ahead: Future Trends in RWA Tokenization

RWA tokenization is expected to evolve toward greater standardization, interoperability, and institutional participation. As the technology matures and regulatory clarity improves, it may become a mainstream investment vehicle.

Interestingly, while many believe DeFi’s future lies in native crypto assets, the integration of RWAs could be a game-changer—bringing trillions of dollars in traditional finance into the blockchain space.

Conclusion: A Landscape of Both Promise and Risk

Rexas Finance represents a significant step in bridging traditional finance with blockchain. By offering a platform for digitizing real-world assets, it enhances liquidity and lowers barriers to entry. However, challenges remain—regulation, security, and trust must be addressed for widespread adoption. That said, Rexas Finance has notable strengths, including comprehensive tooling and diversified asset support. With faster ecosystem development, its future prospects are promising.

Counterintuitively, RWA tokenization might not aim to disrupt traditional finance—but to enhance it, making financial systems more efficient, transparent, and inclusive.

FAQ

Q: What is RWA tokenization and why is it important?

A: RWA tokenization involves converting real-world assets—like real estate or precious metals—into blockchain tokens. This increases liquidity, improves accessibility, lowers investment barriers, and expands opportunities within the DeFi ecosystem.

Q: What are Rexas Finance’s main advantages?

A: Rexas Finance provides a suite of tools to tokenize and manage a variety of real-world assets. It emphasizes transparency, efficiency, and diversified asset options through blockchain technology.

Q: What are the major challenges in RWA tokenization?

A: Key challenges include regulatory compliance, asset security, user trust, and the development of reliable technical infrastructure. Overcoming these requires collaborative industry effort.

Related Articles

RXS Token Trading Guide: From Presale to Uniswap – A Complete Walkthrough

This guide will walk you through the trading process of the RXS Token, from the restrictions during the presale phase to free trading on Uniswap, helping you trade securely and efficiently.1. Introduc

June 24, 2025

RXS Token Claiming Guide: How to Add a Custom Token from Scratch

What is the RXS Token, and Why Does It Matter?RXS is the native token of the Rexas Finance platform, used for governance, staking, and other platform functionalities. If you’ve participated in any Rex

June 19, 2025

What is the RXS Token? The Ultimate Guide to Participating in the Rexas Finance Ecosystem

This guide provides a comprehensive overview of the RXS Token—its purpose, how to obtain it, and practical ways to engage in the Rexas Finance ecosystem.1. What is RXS? A Deep Dive into Rexas Finance’

June 19, 2025

Rexas Finance Beginner’s Investment Guide: From Getting Started to Mastery

This guide walks you through the full process of investing on Rexas Finance—from understanding DeFi fundamentals and setting up a Web3 wallet (like MetaMask or Trust Wallet), to connecting your wallet

June 15, 2025

Rexas Finance Enters Asset Tokenization: Unlocking the Power of Real-World Assets On-Chain

Rexas Finance is pioneering the tokenization of real-world assets (RWA), including real estate, fine art, gold, and corporate bonds—ushering in a new era of blockchain-meets-traditional-finance that c

June 15, 2025