MEV (Maximal Extractable Value) is a key concept in the cryptocurrency ecosystem. Initially referred to as "Miner Extractable Value," MEV has evolved with the rise of decentralized finance (DeFi) to encompass not only miners but also validators. It refers to the profit opportunities available by manipulating the order, insertion, or removal of transactions within a blockchain network.

How MEV Works

In blockchain networks, each transaction is included in a block in a specific sequence. On certain blockchains, miners or validators have control over the order of transactions. This ordering can affect prices and arbitrage opportunities. By reordering or inserting transactions, miners can gain profit.

Common MEV techniques include:

- Front-running: Miners or bots detect transactions in the mempool and submit similar transactions to get processed first, allowing them to profit.

- Back-running: Miners observe large pending transactions and execute related transactions immediately after to exploit arbitrage opportunities.

- Sandwich Attacks: Combining front-running and back-running, attackers place transactions both before and after a user's transaction, manipulating market prices to gain unfair profits.

Example

Imagine Alice is buying tokens on a decentralized exchange (DEX) with 1000 USDC. A miner or MEV bot sees this trade and submits a similar buy order before Alice’s transaction. Since the miner's transaction gets processed first, they benefit from the subsequent price increase caused by Alice's order. The miner then sells the tokens at a higher price, profiting from the front-running strategy.

Watch videos to learn

Impact of MEV

- Negative Effects: MEV strategies can harm regular users, especially when large-scale operations manipulate market prices. For instance, sandwich attacks can result in users paying much higher fees than expected.

- Positive Effects: In some cases, MEV can improve market liquidity and efficiency. Some projects even design mechanisms to steer MEV towards positive outcomes.

MEV Solutions

Several solutions have been proposed to mitigate the negative effects of MEV:

- Flashbots: An open-source project on Ethereum that allows miners and traders to collaborate, reducing front-running and sandwich attacks.

- Auction-based ordering: Some blockchains auction transaction ordering rights to the highest bidder, reducing miner's discretionary control.

Transaction Pool and MEV

Many MEV operations are closely tied to transaction pools, which are collections of unconfirmed transactions. Miners can view these transactions before packing them into blocks and adjust the order to their advantage. To prioritize their transactions, users often pay higher gas fees, which can lead to gas wars between users and MEV bots, driving up network fees.

MEV in DeFi

In the DeFi ecosystem, the transparency of transactions makes MEV strategies particularly common. MEV bots can easily front-run or back-run large trades on decentralized exchanges or manipulate liquidity provision to gain profits from arbitrage across platforms.

Three Types of MEV

- Natural MEV: Profiting from natural market opportunities, such as arbitrage, which can help improve market efficiency.

- Malicious MEV: Gaining profit through transaction order manipulation, such as sandwich attacks, which are generally unfair to users.

- Extractive MEV: Miners deliberately delaying certain transactions to maximize their own profit.

Flashbots: Combating MEV Abuse

Flashbots tackle MEV abuse by creating a private transaction pool where traders can interact directly with miners, bypassing public mempools and avoiding attacks like front-running and back-running. Flashbots also introduce an MEV auction system, allowing traders to bid fairly for transaction execution without gas wars.

MEV and Layer 2 Solutions

As Layer 2 technologies (such as Optimistic Rollups and ZK-Rollups) continue to develop, the influence of MEV diminishes. Layer 2 systems aggregate transactions and process them off-chain, reducing the ability of miners to control transaction order and, consequently, lowering the likelihood of MEV operations.

Why MEV Deserves Attention

Impact on User Experience

MEV can lead to increased transaction costs and unexpected outcomes, especially in cases of front-running and sandwich attacks. Users may have to pay higher fees or execute trades under unfavorable market conditions, affecting the fairness and usability of DeFi applications.

Market Transparency and Fairness

MEV operations have the potential to undermine market transparency and fairness. When miners or validators manipulate transaction order for profit, it can cause abnormal market price fluctuations. As MEV operations become more widespread, the core principles of decentralized markets—fairness and transparency—may be challenged. Understanding and mitigating MEV is crucial to ensuring market integrity.

Transaction Costs and Network Efficiency

MEV often leads to gas bidding wars, driving up transaction fees, particularly on networks like Ethereum. This not only increases costs for users but can also reduce overall network efficiency. Limiting or managing MEV can help alleviate network congestion, lower fees, and improve blockchain performance.

Blockchain Security and Sustainability

Excessive concentration of MEV could threaten the security of blockchain networks. In proof-of-stake (PoS) systems, validators may abuse transaction ordering rights for short-term gains. Over time, this could weaken blockchain sustainability and erode trust in the network.

Long-Term Health of the DeFi Ecosystem

MEV is particularly important in the DeFi ecosystem. As decentralized finance continues to grow, unchecked MEV could destabilize market structures and trigger broader systemic risks. By understanding MEV and implementing mitigation strategies, we can ensure the long-term health, innovation, and growth potential of the DeFi ecosystem.

Conclusion

MEV is a complex and critical phenomenon in the blockchain ecosystem. While it presents opportunities for miners and arbitrageurs, it also poses risks to regular users. Understanding MEV is essential for blockchain users and developers, especially in DeFi, where MEV strategies can affect the fairness and transparency of transactions.

FAQ

Q: How does MEV affect my trades?

A: MEV can increase your trading costs, especially in cases of front-running or sandwich attacks. Understanding MEV can help you choose the right timing for your trades, reducing potential losses.

Q: How can I identify MEV operations?

A: Monitor price fluctuations and execution times. If you notice that your trade price is significantly higher than expected, or if large trades immediately follow your order, these may be signs of MEV activity.

Q: Are there tools that can help me avoid MEV?

A: Yes, tools like Flashbots offer users private transaction pools, helping to avoid front-running or sandwich attacks that occur in public pools.

Q: What impact does MEV have on DeFi projects?

A: MEV can lead to decreased liquidity and eroded user trust, adversely affecting the healthy development of DeFi projects. Understanding MEV helps developers design fairer protocols.

Q: What are the future trends for MEV?

A: With the advancement of Layer 2 solutions and improvements in transaction ordering mechanisms, MEV may be effectively controlled, reducing its negative impact on users, while also encouraging the market to move towards greater transparency and fairness.

Related Articles

What is SparkLend? A Beginner-to-Advanced Guide to Decentralized Lending Made Easy

SparkLend is a decentralized, non-custodial liquidity market protocol built on the Ethereum blockchain. Simply put, it functions like a bank without intermediaries, allowing users to borrow and lend d

June 26, 2025

What is sUSDS? How Do I Acquire sUSDS?

This guide will walk you through Sky Savings’ sUSDS and sUSDC—your gateway to earning yield with stablecoins while keeping your funds secure.Sky Savings: Your Journey to Stablecoin Yields Begins HereW

June 26, 2025

What is SparkLend? A Complete Guide from Beginner to Pro

SparkLend is a decentralized, non-custodial liquidity market protocol that allows users to participate as lenders or borrowers. Lenders provide liquidity to earn passive income, while borrowers can ta

June 24, 2025

What Exactly Does Spark Protocol Do? A Complete Guide

This guide will walk you through Spark Protocol — an innovative platform designed to tackle the long-standing issue of fragmented liquidity in the DeFi space. You'll learn how to earn yield, borrow as

June 24, 2025

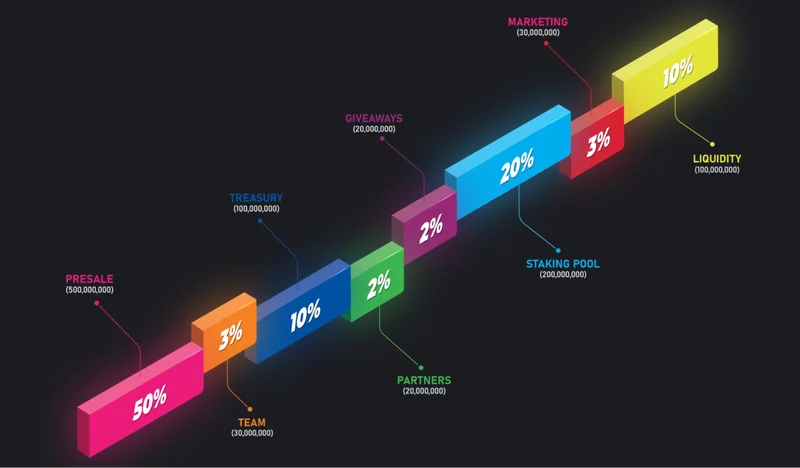

RXS Token Trading Guide: From Presale to Uniswap – A Complete Walkthrough

This guide will walk you through the trading process of the RXS Token, from the restrictions during the presale phase to free trading on Uniswap, helping you trade securely and efficiently.1. Introduc

June 24, 2025