KYC (Know Your Customer) is an identity verification process used to identify and confirm the true identity of users on trading platforms. Its purpose is to prevent money laundering, terrorist financing, and other illegal activities, ensuring the safety and legality of financial transactions. Regulatory bodies in various countries often mandate cryptocurrency exchanges to implement KYC to comply with laws and regulations and to safeguard user funds.

How KYC Works

KYC primarily operates by collecting and verifying users' personal information (such as name, address, identity proof, etc.) to ensure the legitimacy of their identity. The specific process includes:

Information Collection

When users register on a trading platform, they provide basic personal information, such as full name, address, date of birth, and ID or passport number.

Verification of Document Authenticity

The platform checks the identity documents provided by users (such as passports, IDs, or driver's licenses) through third-party services or internal systems to ensure the information is legitimate and authentic.

Screening Against Global Sanctions Lists

The trading platform further screens the user's identity against international sanctions lists or blacklists to prevent risky individuals from engaging in transactions.

Ongoing Monitoring

KYC is not a one-time task at registration; it is a continuous process. The platform periodically reviews users' account activities to detect any unusual behavior.

KYC Implementation Process

- Account Registration New users registering on a trading platform must provide basic information like their name, email address, and set up a password.

- Uploading Identity Verification Documents After initial registration, users are required to upload identity verification documents such as passports, IDs, or driver's licenses. They may also need to submit a selfie holding the document to confirm consistency between the document and the user.

- Address Verification To further verify identity, the platform typically requires proof of address. Common documents include utility bills or bank statements displaying the user's name and current address.

- Verification of User Information The trading platform uses techniques like Optical Character Recognition (OCR) to automatically scan and extract information from uploaded documents and compare it with the data provided by the user. In some cases, manual review may be used if the system fails to recognize the document.

- Risk Assessment Some platforms analyze the user's geographic location, occupation, and source of funds to generate a risk score. If the user is from a high-risk country or industry, the platform might strengthen its review or limit the user's transaction permissions.

Technology and Innovation in KYC

KYC implementation relies on various technological methods to ensure the security and effectiveness of identity verification. Key technologies include:

- Optical Character Recognition (OCR): Quickly reads and extracts text from identity documents to improve verification efficiency.

- Facial Recognition: Compares the uploaded user photo with the ID photo to ensure a match.

- Blockchain and Decentralized Identity Systems: Some cryptocurrency platforms use blockchain technology to create a more transparent and trustworthy identity verification system, allowing users to store their identity information securely on the blockchain.

- Artificial Intelligence (AI) and Machine Learning: AI helps analyze user behavior and transaction patterns to detect potential fraud.

Regulatory Requirements for KYC

Cryptocurrency exchanges around the world face different KYC regulatory requirements, usually set by governments or financial regulatory bodies. For example:

- FINCEN Regulations in the United States: The Financial Crimes Enforcement Network (FINCEN) mandates that all financial institutions, including cryptocurrency exchanges, must implement strict KYC to comply with the Anti-Money Laundering Act (AML) and the Bank Secrecy Act (BSA).

- EU's Anti-Money Laundering Directive: The European Union's Fifth Anti-Money Laundering Directive (5AMLD) requires all cryptocurrency exchanges to implement KYC to prevent illegal use of funds.

These regulations not only set KYC requirements for exchanges but also include strict standards for user privacy, data storage, and transmission.

Practical Application of KYC in Bitcoin Transactions

- Exchange Registration: Leading trading platforms like Binance and Coinbase require KYC verification during user registration, acting as the entry threshold to the market.

- Increasing Limits: Many platforms set different transaction limits based on the user's KYC level. Users who complete basic KYC may only be allowed small transactions, while submitting more verification information can unlock higher limits.

- Preventing Illegal Activities: KYC ensures compliance in transactions and helps platforms identify and prevent potential illegal activities, such as money laundering and terrorist financing using Bitcoin.

Importance of KYC

KYC is the cornerstone of security in Bitcoin transactions, and its importance is reflected in the following aspects:

- Prevention of Money Laundering and Terrorist Financing: By verifying user identities, KYC effectively prevents criminals from using Bitcoin transactions for illegal fund movements.

- Protection of User Funds: KYC helps platforms monitor account activities to prevent hackers from exploiting anonymous identities to steal user funds.

- Ensuring Compliance: KYC enables platforms to comply with national and international financial regulations, avoiding penalties or shutdowns for failing to meet legal obligations.

Limitations and Challenges of KYC

While KYC plays a positive role in risk prevention, it also has some limitations and challenges:

- Privacy Concerns: KYC requires users to provide extensive personal information, which could lead to privacy breaches, especially if the platform's data security is inadequate.

- Cost Issues: For exchanges, implementing KYC can be expensive, particularly when dealing with global users and meeting different legal requirements.

- Increased User Barriers: KYC may inconvenience some users, especially those without proper identification, such as people without bank accounts or identity documents, potentially excluding them from the cryptocurrency market.

Future Trends and Improvements

As the cryptocurrency market evolves, KYC processes are continually optimized. Some future directions for improvement include:

- Decentralized Identity Verification Systems: Using blockchain technology for decentralized identity verification allows users to control their identity data and share specific information only when necessary, reducing privacy risks.

- Smarter Verification Processes: With AI technology, platforms can conduct identity verification more efficiently and accurately, reducing user wait times and enhancing the verification experience.

Related Articles

What is SparkLend? A Beginner-to-Advanced Guide to Decentralized Lending Made Easy

SparkLend is a decentralized, non-custodial liquidity market protocol built on the Ethereum blockchain. Simply put, it functions like a bank without intermediaries, allowing users to borrow and lend d

June 26, 2025

What is sUSDS? How Do I Acquire sUSDS?

This guide will walk you through Sky Savings’ sUSDS and sUSDC—your gateway to earning yield with stablecoins while keeping your funds secure.Sky Savings: Your Journey to Stablecoin Yields Begins HereW

June 26, 2025

What is SparkLend? A Complete Guide from Beginner to Pro

SparkLend is a decentralized, non-custodial liquidity market protocol that allows users to participate as lenders or borrowers. Lenders provide liquidity to earn passive income, while borrowers can ta

June 24, 2025

What Exactly Does Spark Protocol Do? A Complete Guide

This guide will walk you through Spark Protocol — an innovative platform designed to tackle the long-standing issue of fragmented liquidity in the DeFi space. You'll learn how to earn yield, borrow as

June 24, 2025

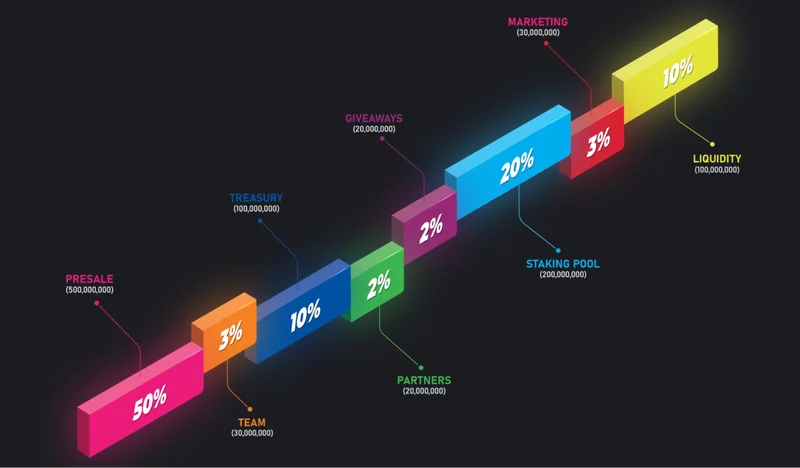

RXS Token Trading Guide: From Presale to Uniswap – A Complete Walkthrough

This guide will walk you through the trading process of the RXS Token, from the restrictions during the presale phase to free trading on Uniswap, helping you trade securely and efficiently.1. Introduc

June 24, 2025