A Bull Market refers to a period in financial markets when the prices of a certain asset or the entire market are continuously rising, accompanied by high investor confidence. It is typically associated with economic expansion and positive market sentiment, where investors generally expect future prices to rise further, leading them to invest more money in purchasing assets. Bull markets can occur in various markets, including the stock market, cryptocurrency market, real estate market, and commodities market.

Details of the Definition of a Bull Market

Sustained Price Increases: The most obvious characteristic of a bull market is the sustained rise in asset prices over a period. This increase can be gradual or rapid, but the overall trend is upward. During a bull market, the market as a whole exhibits an upward trend, with nearly all types of asset prices rising.

Increased Investor Confidence: During a bull market, investors hold an optimistic view of the future market. Even if there are short-term price fluctuations, investors still believe that the market will continue to rise in the future. This confidence, in turn, drives more buying activity, further pushing prices up.

Improved Economic Fundamentals: Bull markets are often accompanied by economic recovery or expansion. Accelerated economic growth, increased corporate profits, declining unemployment rates, and rising consumer spending all positively impact the market. During periods of economic expansion, investors are more inclined to put money into asset markets, driving up market prices.

Optimistic Market Sentiment: Another key feature of a bull market is the generally positive sentiment among market participants. This optimism stems not only from the market performance itself but also from improvements in the macroeconomic environment. News media, analysts, and institutional investors may issue more positive market forecasts, further bolstering market confidence.

High Trading Volume: Due to widespread bullish sentiment among investors, trading volume typically rises significantly during a bull market. More investors enter the market, bringing greater liquidity and higher market activity. High trading volume also means the gap between buying and selling prices (the “bid-ask spread”) narrows, leading to more frequent and smoother transactions.

Duration: A bull market can last for several months or even years, with the specific duration depending on market and economic cycles. Sometimes, a bull market grows at a moderate pace, while other times it is characterized by rapid price surges. Bull markets usually occur during periods of economic expansion but may also start due to policy adjustments or significant market events.

Types of Bull Markets

Structural Bull Market: Driven by strong economic fundamentals, such as technological innovation and corporate profit growth. This type of bull market usually lasts longer, has solid foundations, and carries lower bubble risks.

Cyclical Bull Market: Driven by the natural recovery phase of the economic cycle, typically lasting several years and peaking in the latter stages of economic expansion.

Speculative Bull Market: Dominated by market sentiment and speculative behavior, characterized by rapid price increases but lacking solid fundamentals, making it prone to market bubbles. The end of such a bull market is often accompanied by a swift collapse.

Effects of a Bull Market

Investor Returns: During a bull market, investors often achieve high returns by purchasing and holding assets.

Risk Management: Although a bull market brings profits, prices are often pushed too high at the end of the bull market, posing the risk of bubble bursts, so investors need to manage risks carefully.

How to Trade During a Bull Market?

When trading during a bull market, investors typically employ a series of strategies to maximize returns. Here are some key points for trading in a bull market, including what currency to use and strategies:

Selecting Trading Markets and Assets

Stock Market

Currency: Usually traded in the local currency (e.g., USD, RMB, etc.).

Trading Assets: Stocks, ETFs (Exchange-Traded Funds), index funds, etc.

Cryptocurrency Market

Currency: Exchanges typically support various fiat currencies (e.g., USD, EUR, RMB, etc.) and cryptocurrencies (e.g., Bitcoin, Ethereum, etc.).

Trading Assets: Mainstream cryptocurrencies like Bitcoin, Dogecoin, Ethereum, or other altcoins.

Commodity Market

Currency: Also using the local currency or currencies related to commodities.

Trading Assets: Gold, crude oil, agricultural products, etc.

Trading Strategies

Buy and Hold

Strategy: Purchase assets at the beginning of a bull market and hold them long-term during the bull market, waiting to sell after the asset prices rise.

Suitable For: Investors who have a long-term bullish outlook on the market.

Trend Following

Strategy: Engage in short-term trading based on market trends to capture price increase opportunities. In a bull market, investors can determine entry and exit points by analyzing technical charts.

Suitable For: Investors who prefer rapid trading.

Dollar-Cost Averaging

Strategy: Regularly purchase assets with a fixed amount, regardless of price, to reduce buying costs.

Suitable For: Risk-averse investors looking to minimize the risks associated with lump-sum investments.

Leverage Trading

Strategy: Use borrowed funds for trading to amplify investment returns. During a bull market, many trading platforms allow leverage trading.

Suitable For: Experienced investors who can handle high risks.

Currency Selection

During a bull market, the currency and assets used by investors mainly depend on market types and personal preferences:

Fiat Currency: Such as USD, EUR, etc., suitable for trading in stock and commodity markets.

Cryptocurrencies: Such as Bitcoin, Ethereum, etc., suitable for trading on cryptocurrency exchanges.

Risk Management

Set Stop-Loss: In a bull market, prices can fluctuate, and setting stop-loss orders can help investors protect their capital.

Diversify Investments: Avoid putting all funds into a single asset by diversifying investments to reduce risk.

Stay Informed About Market Dynamics

Economic Data: Monitor macroeconomic indicators (such as GDP growth, unemployment rates, consumer confidence, etc.) to assess whether the bull market will continue.

Technical Analysis: Use charts and indicators to analyze price trends and identify suitable buying and selling opportunities.

When trading in a bull market, investors should choose suitable markets and trading strategies while staying attentive to market dynamics. Additionally, effective risk management is key to successful trading. Whether using fiat currency or cryptocurrencies, understanding the market and one’s investment goals is crucial.

Related Articles

What is SparkLend? A Beginner-to-Advanced Guide to Decentralized Lending Made Easy

SparkLend is a decentralized, non-custodial liquidity market protocol built on the Ethereum blockchain. Simply put, it functions like a bank without intermediaries, allowing users to borrow and lend d

June 26, 2025

What is sUSDS? How Do I Acquire sUSDS?

This guide will walk you through Sky Savings’ sUSDS and sUSDC—your gateway to earning yield with stablecoins while keeping your funds secure.Sky Savings: Your Journey to Stablecoin Yields Begins HereW

June 26, 2025

What is SparkLend? A Complete Guide from Beginner to Pro

SparkLend is a decentralized, non-custodial liquidity market protocol that allows users to participate as lenders or borrowers. Lenders provide liquidity to earn passive income, while borrowers can ta

June 24, 2025

What Exactly Does Spark Protocol Do? A Complete Guide

This guide will walk you through Spark Protocol — an innovative platform designed to tackle the long-standing issue of fragmented liquidity in the DeFi space. You'll learn how to earn yield, borrow as

June 24, 2025

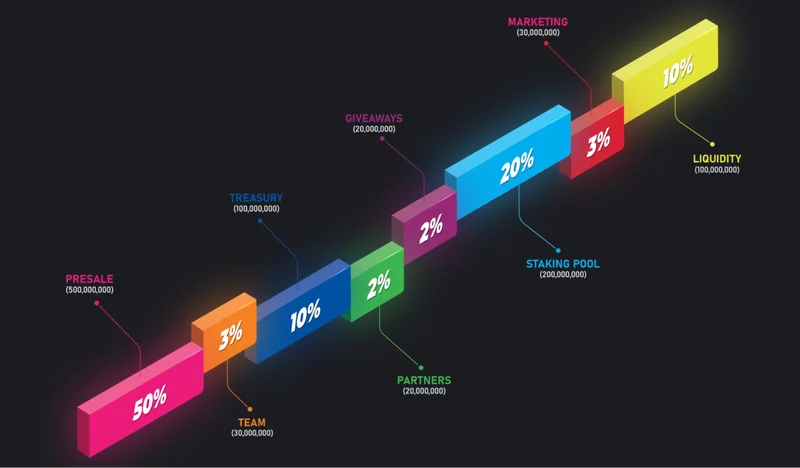

RXS Token Trading Guide: From Presale to Uniswap – A Complete Walkthrough

This guide will walk you through the trading process of the RXS Token, from the restrictions during the presale phase to free trading on Uniswap, helping you trade securely and efficiently.1. Introduc

June 24, 2025