In recent years, Turkey's cryptocurrency market has experienced rapid growth, attracting widespread attention globally. After enduring economic turmoil and currency devaluation, Turkey has swiftly risen to become the fourth largest cryptocurrency trading market in the world, following the United States, India, and the United Kingdom. The Turkish people's preference for cryptocurrencies is not only a direct response to economic instability but also reflects an urgent demand for a store of value. However, the Turkish cryptocurrency market has long lacked regulation, and with the onset of 2024, the introduction of a new regulatory framework has provided direction for the future development of the market.

Economic Pressures Intensify Cryptocurrency Investment Frenzy

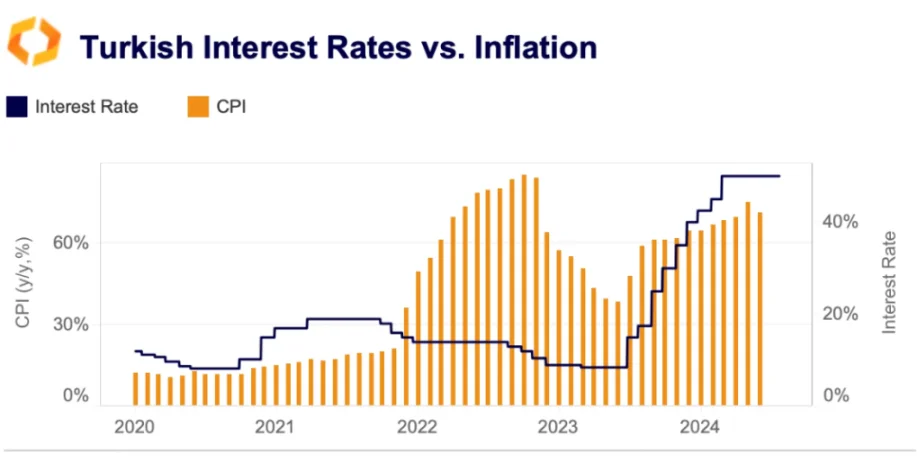

Data shows that since the end of 2020, the Turkish lira has devalued by more than 300%. High inflation and the ongoing depreciation of the lira against the dollar have forced the Turkish populace to seek alternative investment channels to protect their assets. On August 23, 2024, the exchange rate of the lira against the dollar fell below 34 to 1, setting a new historical low, which further propelled the popularity of cryptocurrencies. The Turkish public views digital assets like Bitcoin as effective tools for inflation resistance and risk hedging. In the face of a failing traditional financial system, cryptocurrencies offer them new hope.

Introduction of a New Regulatory Framework

Against the backdrop of increasing global regulation of cryptocurrencies, the Turkish government has finally recognized the necessity of strengthening market oversight. In July 2024, the Turkish parliament passed Amendment No. 7518 to the Capital Markets Law, establishing the first systematic legal framework for crypto asset service providers (CASPs). This amendment marks the initiation of the compliance process for Turkey's cryptocurrency market, with future operations subject to stricter regulation.

According to the new regulations, all crypto asset service providers must obtain a license from the Turkish Capital Markets Board (CMB) and comply with relevant laws and standards. This initiative aims to enhance market transparency and accountability, ensuring the security of investor funds. In particular, the increased regulatory scrutiny will compel trading platforms that have long operated in a legal gray area to either rectify their practices or exit the market.

Implementation Details of Specific Regulations

The new regulations require crypto asset platforms to meet a series of stringent conditions, including registration as joint-stock companies, a minimum paid-in capital of 50 million Turkish lira, and a clearly defined scope of business. These requirements not only raise the market entry threshold but also provide guarantees for the compliant development of the industry. At the same time, existing crypto asset service providers must submit relevant documents within a specified timeframe, with non-compliance leading to expulsion.

It is noteworthy that the amendment sets severe penalties for violations. Unauthorized crypto asset services may face imprisonment of 3 to 5 years and hefty fines, while misappropriation of user assets will incur even harsher penalties. The implementation of these measures is expected to effectively combat illegal activities and protect investor interests.

Shifts in Attitudes Towards Cryptocurrencies

The Turkish government's attitude towards cryptocurrencies has evolved from initial laissez-faire to a gradual shift towards regulation. Although the early government was cautious about cryptocurrencies, viewing them as risky, the growing popularity of cryptocurrencies among the public made the government realize the need to take measures to protect investor rights and market stability. In the context of economic pressures and high inflation, the Turkish public's trust in cryptocurrencies has steadily increased, prompting the government to start accepting this emerging asset class and seek to establish corresponding laws and regulations to regulate the market.

User Expectations

Users' expectations for the cryptocurrency market primarily reflect the following aspects:

- Security: Users hope that, under a compliant framework, exchanges and platforms can provide higher security, reducing the risks of fraud and hacking.

- Transparency: Users look forward to obtaining more transparent information through the implementation of regulatory policies, ensuring a solid basis for investment decisions.

- Accessibility: Users desire more legitimate platforms to offer a diverse range of cryptocurrency trading options to meet the growing investment demand.

- Education and Support: Users' understanding of cryptocurrencies is still in its early stages, and they expect the government and industry to provide more education and resources to help them understand the characteristics and risks of cryptocurrencies.

Impact on the Industry

Compliance will drive market structure optimization, prompting market participants to enhance service quality, stimulate technological innovation, and foster market competition. With strengthened regulation, investor trust in the market will improve, attracting more capital inflow. Meanwhile, stringent penalties for violations will effectively combat illegal activities, protect investors' legitimate rights and interests, and enhance the overall image of the industry.

Uncertainty and Outlook

Despite the introduction of new policies, the stability of policy implementation and market reactions still need to be observed. How market participants adapt to the new regulations, especially those operating in gray areas, remains unclear. Furthermore, the rapid technological changes and market dynamics within the cryptocurrency industry may pose challenges to existing regulations.

Turkey's cryptocurrency market is at a critical juncture of transformation. The implementation of the Capital Markets Law Amendment will significantly enhance market compliance and transparency. This transition not only strengthens investor trust but also lays a solid foundation for future growth. Despite uncertainties regarding policy execution stability and market reactions, the outlook for Turkey's cryptocurrency market remains bright, potentially playing an increasingly important role in the global crypto market.

Conclusion

With the establishment of a new regulatory framework, Turkey's cryptocurrency market is poised for healthier and more sustainable development. While challenges persist, the compliance process will bring greater stability and trust to the market. The entry of internationally renowned exchanges will also encourage local companies to improve service quality, driving technological innovation and market competition. During this critical transformation period, participants in Turkey's cryptocurrency market must not only respond to new regulatory requirements but also seize the opportunities presented by industry developments. As regulations continue to improve and the market matures, Turkey's cryptocurrency market may welcome a new era of prosperity.

Related Articles

What is SparkLend? A Beginner-to-Advanced Guide to Decentralized Lending Made Easy

SparkLend is a decentralized, non-custodial liquidity market protocol built on the Ethereum blockchain. Simply put, it functions like a bank without intermediaries, allowing users to borrow and lend d

June 26, 2025

What is sUSDS? How Do I Acquire sUSDS?

This guide will walk you through Sky Savings’ sUSDS and sUSDC—your gateway to earning yield with stablecoins while keeping your funds secure.Sky Savings: Your Journey to Stablecoin Yields Begins HereW

June 26, 2025

What is SparkLend? A Complete Guide from Beginner to Pro

SparkLend is a decentralized, non-custodial liquidity market protocol that allows users to participate as lenders or borrowers. Lenders provide liquidity to earn passive income, while borrowers can ta

June 24, 2025

What Exactly Does Spark Protocol Do? A Complete Guide

This guide will walk you through Spark Protocol — an innovative platform designed to tackle the long-standing issue of fragmented liquidity in the DeFi space. You'll learn how to earn yield, borrow as

June 24, 2025

RXS Token Trading Guide: From Presale to Uniswap – A Complete Walkthrough

This guide will walk you through the trading process of the RXS Token, from the restrictions during the presale phase to free trading on Uniswap, helping you trade securely and efficiently.1. Introduc

June 24, 2025