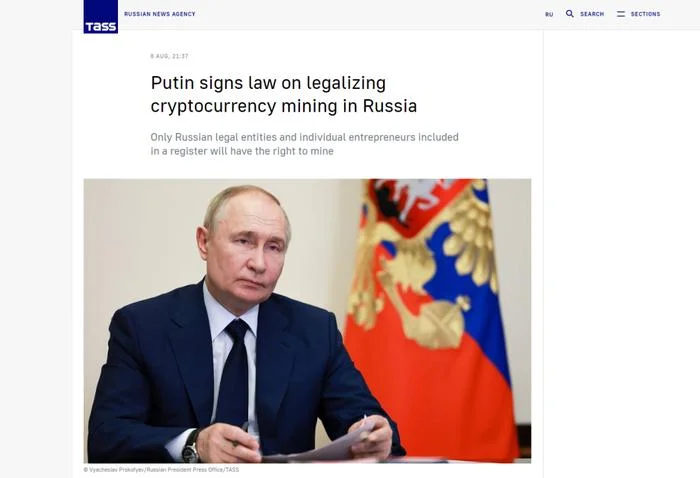

Against the backdrop of increasing financial pressure from Western sanctions, the Russian government recently passed significant legislation that officially legalizes cryptocurrency mining and permits international payments in cryptocurrency. The bill was signed by President Vladimir Putin on August 8 and plans to launch a pilot project for crypto payments this month.

This legislative shift marks a significant change in the Russian government's stance on cryptocurrency policy. Previously, the Central Bank of Russia (CBR) had pushed for a comprehensive ban on cryptocurrencies in 2022. Under the new law, cross-border payments will come into effect in September, while the legalization of cryptocurrency mining is expected to start in November. This move will enable Russian businesses to utilize cryptocurrency for international trade, while authorizing approved entities to mine digital assets.

In signing the bill, Putin emphasized that Russia must "seize the opportunity" to adapt to the rapid development of global cryptocurrency payments and reduce dependence on the dollar. One of the key supporters of the bill, Anton Gorelkin, pointed out that the legislation aims to mitigate the impact of sanctions on the Russian economy and promote international payments.

Policy Background and Market Status

Despite the implementation of the new bill, Russia still prohibits the use of cryptocurrencies in domestic payments. However, this restriction has not been able to curb the widespread use of cryptocurrencies in the country. According to various authoritative cryptocurrency adoption indices, Russia has long ranked high in global cryptocurrency usage, highlighting the ineffectiveness of the comprehensive ban. In fact, many cryptocurrency trading activities have shifted to informal channels or more loosely regulated environments.

Before the new legislation was introduced, banking services related to cryptocurrencies in Russia had significantly increased. According to Kommersant, Rosbank, owned by billionaire Vladimir Potanin, began offering cross-border cryptocurrency payment services to businesses since June last year, with other banks following suit.

Strategies for Evasion of Sanctions

The Central Bank of Russia is promoting the integration of cryptocurrencies into the country's cross-border payment system, establishing experimental infrastructure for approved enterprises to conduct international transactions using digital currencies. Additionally, approved mining entities will also be allowed to settle transactions using cryptocurrencies.

This legislative effort is not only a response to sanctions but also reflects Russia's long-term goal of seeking alternative payment mechanisms. Especially amid escalating geopolitical tensions, reducing dependence on the dollar has become particularly important.

New Regulatory Scope and International Cooperation

The new bill enhances the Central Bank of Russia's regulatory authority over cryptocurrencies, enabling it to monitor related transactions more effectively. While the central bank is still testing its Central Bank Digital Currency (CBDC), with plans to launch the digital ruble in 2025, the new legislation allows the use of existing cryptocurrencies under the central bank's supervision.

To circumvent the U.S.-led financial system, Russia has explored various alternatives, including blockchain initiatives in collaboration with BRICS nations and the introduction of gold-backed stablecoins in partnership with Iran. Additionally, Russia's Financial Messaging System (SPFS), an alternative to SWIFT, remains an important component of this strategy, despite its currently limited usage.

The Future of Cryptocurrency Exchanges

According to Bloomberg, Russian authorities are studying how to legalize cryptocurrency exchanges. Finance Minister Anton Siluanov stated that a specific solution has not yet been found. However, reports indicate that Russia is advancing plans to establish new cryptocurrency exchanges in Saint Petersburg and Moscow.

Despite the complex regulatory environment, Russia has developed a relatively mature cryptocurrency ecosystem. Some large non-KYC exchanges, such as Garantex, continue to play a significant role in the Russian market. Despite facing international sanctions, Garantex remains active in handling large volumes of transactions, demonstrating its potential impact in international trading.

The Future of the Economy and Sanctions

Russia's shift in attitude towards cryptocurrencies is both a response to Western sanctions and an effort to push its financial system towards reducing dependence on the dollar. While this new strategy may enhance Russia's capacity to engage in international trade via cryptocurrencies, it may also raise alerts among U.S. and EU authorities.

From a broader perspective, countries like Venezuela, Russia, and Iran are attempting to utilize alternatives, including cryptocurrencies, to cope with sanctions imposed by Western nations. The effectiveness of these actions will be tested in the future international economic landscape, particularly in how Russia manages regulatory barriers, handles sanctioned entities, and establishes the necessary infrastructure and international partnerships.

Timeline of Russia's Shift in Stance on Digital Assets

Russia's stance on digital assets has undergone significant changes, reflecting its strategic adjustments in response to international sanctions and economic challenges. Here are the key milestones of this shift:

- January 2022: The Central Bank of Russia proposed a comprehensive ban on cryptocurrencies for the first time, emphasizing that cryptocurrencies could pose a threat to financial stability and economic security.

- August 2022: Under escalating sanctions pressure, Russia began discussing the potential legalization of cryptocurrencies, with government officials and the central bank reevaluating their role.

- March 2023: President Putin called for the development of a regulatory framework for cryptocurrencies, pointing out their growing importance in global payments.

- August 8, 2023: Putin signed a new bill legalizing cryptocurrency mining and allowing the use of cryptocurrencies for international payments, marking a fundamental shift in the government's position.

- September 2023: The new law officially came into effect, granting Russian businesses the right to use cryptocurrencies for international trade and launching a pilot project for crypto payments.

Russia's Motivations

- Responding to Western Sanctions: A series of economic sanctions imposed by Western countries have severely impacted Russia's economy and financial stability. By legalizing cryptocurrencies, Russia hopes to open new channels for international payments and reduce dependence on the dollar and the Western financial system.

- Promoting Economic Development: The legalization of cryptocurrencies is seen as a crucial means to drive the digital economy and technological innovation. The government aims to enhance economic resilience by attracting investments and developing related industries.

- Strengthening National Regulation: The new legislation empowers the state to supervise and manage cryptocurrency transactions, aiming to control this emerging market and prevent its use for money laundering or other illegal activities.

- Enhancing International Competitiveness: Russia seeks to establish a leading position in the fields of cryptocurrency mining and trading, thereby strengthening its status and influence in the global economy.

Impact on the Market

- Increased Market Confidence: The legalization of cryptocurrencies has boosted confidence among market participants, driving investment enthusiasm for the Russian cryptocurrency market. Businesses and investors are starting to actively explore new business opportunities.

- Rise of Exchanges: With the progression of legislation, the number of domestic cryptocurrency exchanges in Russia has increased, especially in the Moscow and Saint Petersburg regions, providing new trading platforms for businesses and individuals.

- International Payment Solutions: The new legal framework will facilitate the use of cryptocurrencies in international payments, especially in transactions with sanctioned countries, providing merchants with new options.

- Market Differentiation: Although the legalization of cryptocurrencies brings opportunities to the market, regulatory uncertainties and compliance risks still exist, potentially leading to a division among market participants. Some large international exchanges may choose to exit the Russian market, while domestic exchanges may experience greater growth opportunities.

- Compliance and Risk Management: The involvement of regulatory authorities will require businesses to implement more stringent compliance and risk management practices, ensuring their operations align with new regulations while avoiding potential legal risks.

Russia's legalization of cryptocurrency mining and international payments represents a significant step towards embracing digital assets and adapting to changing geopolitical circumstances. However, the future development of the Russian cryptocurrency market will still face challenges, requiring careful navigation of regulatory landscapes and evolving market dynamics.

FAQ

Q: Why is Russia legalizing cryptocurrency mining and international payments?

A: Russia is legalizing cryptocurrency mining and international payments mainly to respond to the economic sanctions imposed by Western countries. This legislation aims to create new international payment channels, reduce dependence on the U.S. dollar and the Western financial system, and enhance economic resilience and stability.

Q: How will the cryptocurrency market in Russia change after the implementation of the new law?

A: The new law will drive rapid development in Russia's cryptocurrency market, increase the number of local exchanges, and promote the adoption of international payment solutions. This will boost the confidence of market participants, attract more investments, and provide new business opportunities for enterprises.

Q: What is the role of the Russian government in cryptocurrency regulation?

A: The new law grants the Central Bank of Russia greater regulatory power, enabling it to effectively monitor cryptocurrency transactions. This regulatory measure aims to ensure the legitimacy of the cryptocurrency market and prevent illegal activities such as money laundering, while providing a framework for legitimate transactions.

Q: What new cooperative strategies does Russia have in the field of international payments?

A: Russia is exploring various cooperative strategies, including blockchain initiatives with BRICS nations and collaborating with Iran to launch a gold-backed stablecoin. Additionally, Russia’s Financial Messaging System (SPFS) is seen as an alternative to SWIFT; although its current usage is limited, it is a key component in achieving alternative payment mechanisms.

Q: What impact will this legislation have on Russia's financial market and international image?

A: This legislation will help enhance Russia's competitiveness in the global cryptocurrency field and improve its image in international financial markets. Successful implementation of these policies may allow Russia to reintegrate into the global financial system, but it could also raise concerns and reactions from other countries.

Related Articles

What is SparkLend? A Beginner-to-Advanced Guide to Decentralized Lending Made Easy

SparkLend is a decentralized, non-custodial liquidity market protocol built on the Ethereum blockchain. Simply put, it functions like a bank without intermediaries, allowing users to borrow and lend d

June 26, 2025

What is sUSDS? How Do I Acquire sUSDS?

This guide will walk you through Sky Savings’ sUSDS and sUSDC—your gateway to earning yield with stablecoins while keeping your funds secure.Sky Savings: Your Journey to Stablecoin Yields Begins HereW

June 26, 2025

What is SparkLend? A Complete Guide from Beginner to Pro

SparkLend is a decentralized, non-custodial liquidity market protocol that allows users to participate as lenders or borrowers. Lenders provide liquidity to earn passive income, while borrowers can ta

June 24, 2025

What Exactly Does Spark Protocol Do? A Complete Guide

This guide will walk you through Spark Protocol — an innovative platform designed to tackle the long-standing issue of fragmented liquidity in the DeFi space. You'll learn how to earn yield, borrow as

June 24, 2025

RXS Token Trading Guide: From Presale to Uniswap – A Complete Walkthrough

This guide will walk you through the trading process of the RXS Token, from the restrictions during the presale phase to free trading on Uniswap, helping you trade securely and efficiently.1. Introduc

June 24, 2025