Amid a lively atmosphere, the Token2049 conference successfully concluded, with attendance reaching double that of last year, exceeding 20.000 participants. This remarkable turnout has drawn widespread attention from industry insiders, with many participants comparing the event to the visitor numbers of F1 races, believing that this crypto event attracted even more participants. During the conference, overseas attendees and speakers made up more than half of the crowd, marking Token2049 as potentially the most successful edition in history.

Current Industry Status: A Desire for Real Users and New Capital

Despite a seemingly prosperous surface, the industry harbors concerning realities. Many participants are busy chasing false data and revenues, attempting to mislead exchanges and investors; while in the tech community, some individuals are engrossed in academic discussions, neglecting the fact that infrastructure development should center around applications and users. Although exchanges have become winners due to excellent revenue models and provide superior work environments and salaries, startups face severe challenges in recruiting top talent. Beneath this prosperous facade, few discuss how to attract real users, create stable revenues, and sustainable business models.

In the fundraising environment, only a few highly-configured niche projects receive support, while most ordinary startup teams struggle to secure funding. As industry trends gradually shift towards “rallying to Binance,” many projects experience a rapid decline in user activity after launch, with frequent cash-out occurrences. This model not only severely harms the interests of community retail investors but also undermines the liquidity of the entire industry.

Innovation and Trust Crisis

The underperformance of altcoins has forced industry participants to reevaluate the importance of innovation and real applications. There are significant discrepancies in the interests of venture capitalists, exchanges, project parties, and retail investors, leading to a lack of trust and cooperation among them. Without necessary reforms, the industry will face greater challenges. While Bitcoin remains successful, the future of the entire Web3 industry appears precarious.

In the past two years, 90% of Gamefi projects have experienced a price drop after listing, with few successful cases like Axie Infinity and Stepn emerging in the industry. Although some projects, such as Pirate Nation and Small Brain, backed by A16Z, have a solid community foundation, the overall gaming sector remains challenging. In light of this situation, we urgently need to find teams that believe in the crypto market to create more appealing gaming products.

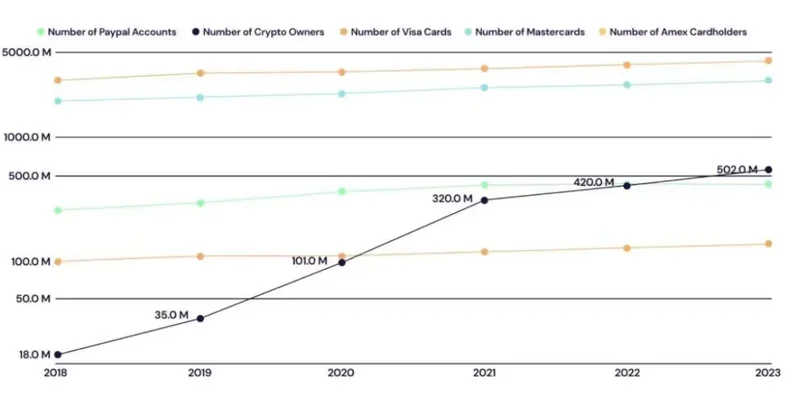

The user growth in the new cycle is far behind the level of user entry in the previous cycle.

Adjusting Token Utility and Lock-up Periods

In terms of token utility and unlocking terms, there is a general consensus in the industry that adjustments are necessary. Compared to the investment lock-up periods of traditional IPOs, many early seed round companies have liquidity lock-up periods lasting 3 to 4 years, resulting in a lack of token utility. In the early stages of a project’s launch, market makers provide price support, but over time, the project team and exchanges gradually pay less attention to price, leaving retail investors' interests inadequately protected.

If industry participants continue to be consumed by fantasies of a bull market without focusing on actual application scenarios and the needs of real users, the future will fall into a situation of “eating the mountain bare.” Those enjoying early dividends may not understand the difficulties faced by most entrepreneurs. The power of success should guide the industry’s development, helping more people strengthen their beliefs and confront new challenges.

Seeking Long-term Collaborative Opportunities

After speaking with a leader of a well-known exchange, we learned that the biggest consensus within the exchange is the search for long-term oriented entrepreneurs. Past founders who achieved success through false data ultimately chose to cash out, leaving debts for the community. Now, long-term oriented entrepreneurs are dedicated to achieving sustainable growth and seeking reliable business scenarios.

The Future of Ethereum and Emerging Markets

At Token2049. the future of Ethereum became a hot topic of discussion. Following “The Merge,” Ethereum entered a deflationary cycle; however, recent trading sluggishness poses inflation risks. Despite the Ethereum ecosystem’s TVL growing from about $34 billion a year ago to $88 billion, with a growth rate of 159.5%, this prosperity is largely driven by significant airdrops and liquidity mining, leading to a false sense of abundance.

In recent months, the monthly active user count for MetaMask has dropped from a peak of 30 million to 1 million, marking a significant decline in user activity. With the fragmentation of liquidity across various chains, developers and users are increasingly turning to chains with rich subsidies, leading to widespread dispersion of applications, developers, and users.

Today, Ethereum is facing unprecedented scrutiny. Since the launch of ETFs, over $1.2 billion has flowed out, exacerbating the trust crisis. The core team of Ethereum and its founders need to provide direction for participants to navigate this severe test.

Discussions about the Ton ecosystem garnered considerable attention during the conference. Although Western funds hold a cautious attitude toward Ton, its vitality in the crypto market cannot be underestimated. Leveraging Telegram's user base, Ton has the potential to bring new user growth to Web3.

Editor's Note

In this challenging cycle, we look forward to more successful forces leading the future of the industry, helping entrepreneurs explore true value and innovation together.

FAQ

Q: What are the main issues currently facing the blockchain industry?

A: The blockchain industry is currently grappling with issues such as chasing false data and revenues, a lack of attraction for real users, difficulties in fundraising, and challenges faced by startups in recruiting top talent. These problems have resulted in insufficient attention to sustainable business models within the industry.

Q: How can industry participants improve their relationship with users?

A: Industry participants can improve their relationship with users and attract more real users by focusing on the needs of genuine users, building user-centric applications and infrastructure, and creating sustainable business models.

Q: What is the future outlook for Ethereum?

A: The future outlook for Ethereum faces challenges. Despite significant growth in its ecosystem's TVL, recent trading sluggishness, a decline in user activity, and a deepening trust crisis have introduced considerable uncertainty regarding Ethereum's future development.

Q: What is the importance of long-termism for blockchain entrepreneurs?

A: Long-termism is crucial for blockchain entrepreneurs as it emphasizes sustainable growth and reliable business scenarios. Entrepreneurs who adopt a long-term perspective can stand out in an environment saturated with false data, build trust, and help the industry achieve healthy development.

Related Articles

What is SparkLend? A Beginner-to-Advanced Guide to Decentralized Lending Made Easy

SparkLend is a decentralized, non-custodial liquidity market protocol built on the Ethereum blockchain. Simply put, it functions like a bank without intermediaries, allowing users to borrow and lend d

June 26, 2025

What is sUSDS? How Do I Acquire sUSDS?

This guide will walk you through Sky Savings’ sUSDS and sUSDC—your gateway to earning yield with stablecoins while keeping your funds secure.Sky Savings: Your Journey to Stablecoin Yields Begins HereW

June 26, 2025

What is SparkLend? A Complete Guide from Beginner to Pro

SparkLend is a decentralized, non-custodial liquidity market protocol that allows users to participate as lenders or borrowers. Lenders provide liquidity to earn passive income, while borrowers can ta

June 24, 2025

What Exactly Does Spark Protocol Do? A Complete Guide

This guide will walk you through Spark Protocol — an innovative platform designed to tackle the long-standing issue of fragmented liquidity in the DeFi space. You'll learn how to earn yield, borrow as

June 24, 2025

RXS Token Trading Guide: From Presale to Uniswap – A Complete Walkthrough

This guide will walk you through the trading process of the RXS Token, from the restrictions during the presale phase to free trading on Uniswap, helping you trade securely and efficiently.1. Introduc

June 24, 2025