As cryptocurrency gradually evolves into a global industry, the dominance of Western and English-speaking opinion leaders (KOLs) may cause us to overlook potential opportunities in non-Western markets.

You might be surprised to find that OpenSocial has more users than Farcaster and Lens, despite their relatively low exposure on the X platform. So, what’s the secret to their success? Clearly, Indonesia, Vietnam, and India are their primary user bases.

I teamed up with Mai, the founder behind the official Pink Brains account on X, to delve into insights about the South Asian crypto market. Additionally, I interviewed several users from South Asia to share their personal experiences and insights.

South Asia - The Wilderness of Cryptocurrency

Token2049 in Singapore is undoubtedly the largest cryptocurrency event of 2024, and one impressive takeaway from Andy’s presentation was: “The Asian market is still underdeveloped.”

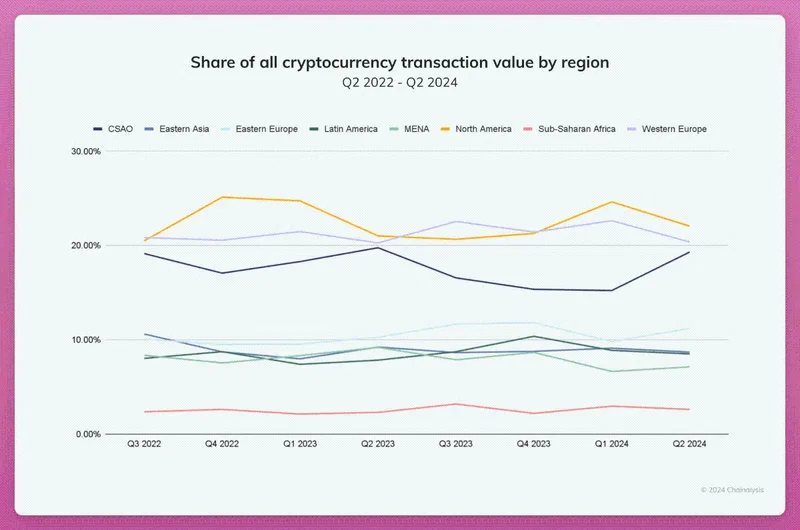

While East Asia—including South Korea, Hong Kong, Taiwan, China, and Japan—has become a major cryptocurrency hub with clear regulatory policies and the participation of large institutions and professional investors, Central and Southern Asia and Oceania (CSAO) have adopted a different approach to cryptocurrency, often overlooked in Western crypto Twitter.

Below is the 2024 Chainalysis Global Cryptocurrency Adoption Index map.

According to Chainalysis, the Central and Southern Asia and Oceania (CSAO) region is the third-largest cryptocurrency market, with over $750 billion flowing in between July 2023 and June 2024. This accounts for 16.6% of the global total. Let that number sink in. Only North America and Western Europe have higher figures.

In the 2024 Global Cryptocurrency Adoption Index, the Central and Southern Asia and Oceania region truly stands out, with seven countries making it into the top 20: India (1), Indonesia (3), Vietnam (5), the Philippines (8), Pakistan (9), Thailand (16), and Cambodia (17).

How South Asians Adopt Cryptocurrency?

Vietnam

First, let’s look at Vietnam, home to most members of our DeFi creator studio Pink Brains, who provided insights from their personal experiences in the market. According to Triple-A data, Vietnam has the second-highest cryptocurrency ownership rate, with about 21.2% of the population holding cryptocurrency, second only to the UAE's 34.4%.

According to Chainalysis data, Vietnam also reaped significant profits last year, ranking third globally with cashable cryptocurrency earnings reaching $1.18 billion. This is double the earnings of Spain and the Philippines, and three times that of Thailand.

One reason for this is the Vietnamese government's ambiguous stance on cryptocurrency. While cryptocurrencies are not banned, their practical use, such as for payments or mortgages, is not permitted. This makes holding cryptocurrency appealing, even though the actual adoption rate lags behind other Southeast Asian countries.

- For most Vietnamese crypto investors, centralized exchanges (CEXs) are the preferred choice. Binance, Bybit, OKX, and BingX are the most popular exchanges, while Coinbase holds a small market share due to language barriers and complex KYC processes. Trading and holding cryptocurrency on CEXs remains the most common investment strategy.

- Airdrops and crypto mining are very popular here. You’ll find numerous Telegram and Facebook groups sharing tips, “hidden treasure” alerts, and token giveaways. In fact, purchasing clone accounts, forging KYC, or setting up bots is very simple and cheap, with almost no hassle. This has made Sybil attacks from Vietnamese farmers a significant challenge for protocols. Some of the major airdrops you may have heard of include Arbitrum, LayerZero, Aptos, and zkSync.

- Most investors in Vietnam are not seasoned traders. They primarily seek quick profits, viewing cryptocurrency as a side job or a life-changing opportunity outside of their main employment. Experienced investors usually look for low market cap tokens on decentralized exchanges (DEXs) while holding significant assets on centralized exchanges (CEXs). Meanwhile, new investors since 2022 often chase airdrops and rewards. Seasoned traders tend to suffer losses during major black swan events (like FTX or Luna), while newcomers frequently incur losses due to misguided KOL signals, scams, or excessive leverage.

- Vietnam is a top nation in international math competitions and a hub for blockchain development talent. You may have heard of notable figures like Loi Luu (Kyber Network) and Vu Nguyen (Pendle), but there are also some notorious serial scammers, like the one behind Whale Markets!

Note: My team has a strong aversion to this person. Please refer to the discussion above to understand how he has harmed investors' interests. Mai also informed me that retail banking and cashless payments are rapidly developing in Vietnam. The country is moving along a path similar to China, with digital wallets, banking apps, and credit cards gradually replacing cash, especially in major cities. This shift is good news for Web3, creating conditions for the popularization of crypto payments, akin to the current situation in Singapore. More and more large companies are beginning to integrate blockchain technology into their operations.

We have already seen some initial tests in the banking sector, such as HSBC Vietnam's first live blockchain experiment for L/C payments. These attempts indicate a strong interest among Vietnamese businesses in blockchain technology.

However, we still need to wait for a more open legal framework regarding cryptocurrency.

India

Despite the ever-changing regulations and taxation in India, the country remains a major player in the global crypto market. India imposes a tax of up to 30% on crypto earnings and a 1% tax on all transactions, leading some investors to seek international exchanges with fewer restrictions. Nevertheless, cryptocurrencies are growing rapidly in India. The rise of innovative crypto startups indicates the need for more favorable tax policies and clearer regulations to maintain this momentum.

I asked Hitesh.eth on X what makes India unique. Besides his unique insights into cryptocurrencies, Hitesh is also developing a platform called DYOR to help people better understand the basics of crypto. India has the largest population of unemployed youth, who are eager to work hard for incentives. If executed properly, applications can guide these incentives through tokens and points, similar to what we saw in Axie in the past. In terms of infrastructure, India boasts some of the best developer resources, at costs significantly lower than those in the EU and the US.

He said, “Over 50% of community-related positions are held by Indians, and many more are eager to enter this field. However, this 'temporary work in cryptocurrency and high ambitions' has led to some issues, as past airdrops have created misconceptions about Indians. Yet, this view should not be generalized, as it is more case-specific than representative.”

Indonesia is one of the fastest-growing markets in terms of trading volume.

According to a product manager at the Indonesian cryptocurrency exchange Pintu, the growth of crypto activity is mainly driven by speculation. “Many people still view crypto as a way to make quick profits,” he said. “Now, many traders turn to Telegram groups for signals, just like they did when trading stocks before, but the activity in the crypto space is even more intense with new tokens constantly emerging.” He also mentioned that the stricter rules at the Indonesian Stock Exchange may be pushing people towards cryptocurrencies. “With the new comprehensive auction measures making stock trading stricter, some investors are looking for alternatives like cryptocurrencies.”

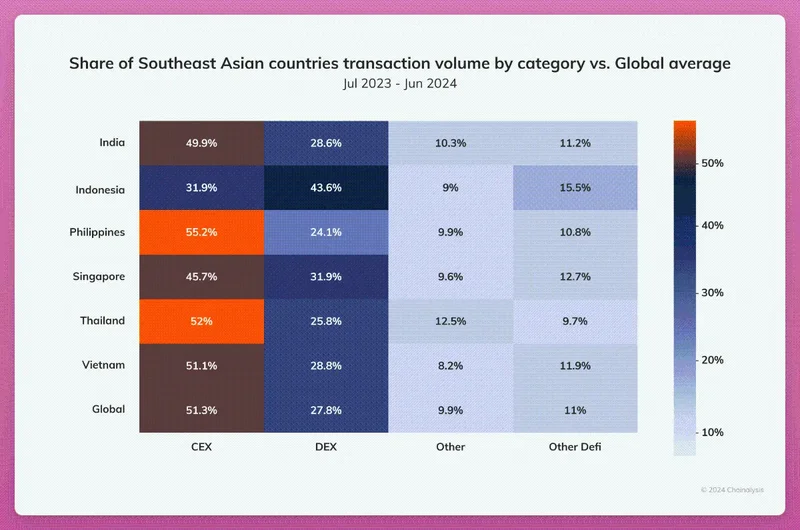

Compared to regional and global averages, Indonesia excels in decentralized exchange (DEX) and decentralized finance (DeFi) activity.

This was confirmed by Eli5DeFi on X, who stated, “Many Indonesians are involved in cryptocurrency trading, often starting with meme coins or airdrops, as they are simpler and more appealing. Airdrops, in particular, usually require just time and effort to participate.”

He added, “Recently, we mainly use the TON app, with some even forming their own communities to mine and earn $DOGS, $NOT, and $HAMSTER.”

As Indonesians become more crypto-savvy, yield farming, staking, and decentralized finance (DeFi) projects are gaining popularity. This growth is forming a new “crypto enthusiast” community, with over half of the investors being millennials and Gen Z, who are seeking emerging technologies and quick profits.

DeFi is also on the rise, with many DeFi builders from Indonesia - Eli5DeFi

Here are a few notable examples:

- @0x_eunice - Co-founder of Monad

- @Mariobern - Co-founder of Pyth

- @bradydonut - Co-founder of HawkFi

- @BrianLimiardi - Co-founder of Copra

- @smsunarto - Founder of Argus Labs

- @bizyugo - No. 1, Debank

- @mathdroid - Pandora

- @PatriaAbditiar - Sociocat

Singapore

While countries like Indonesia and Vietnam see cryptocurrency adoption driven by "crypto degeneration" and the promise of quick profits, the situation in Singapore is different.

Ronald Chan of Saprolings (Web3 Incubator) told me that after China shut down crypto companies, the number of crypto firms in Singapore surged. Here are the reasons they choose Singapore:

- Geographical proximity to China

- Rich Chinese culture

- Loose political environment

- Low tax rates

- A large Mandarin-speaking community

- Free flow of capital (including Bitcoin)

- A strong legal system (which is very important)

- Well-educated personnel to run businesses

- A strong financial center in the region

- Almost no other options in the area

“We protect ourselves by becoming the bank of our neighboring countries.” - Ronald Chan

Furthermore, regulatory advancements and merchant services indicate a greater potential for cryptocurrency beyond just trading and investment. Ronald pointed out that Singapore “issues banking licenses to local and foreign banks to ensure fair competition, which is different from many other countries.”

Additionally, Singapore “has a nationwide QR code scanning system, similar to China's WeChat Pay and Alipay (called Paynow QR), which is widely used. Mastercard and Visa are available everywhere, but users and merchants are not satisfied, as both parties have to pay additional fees.”

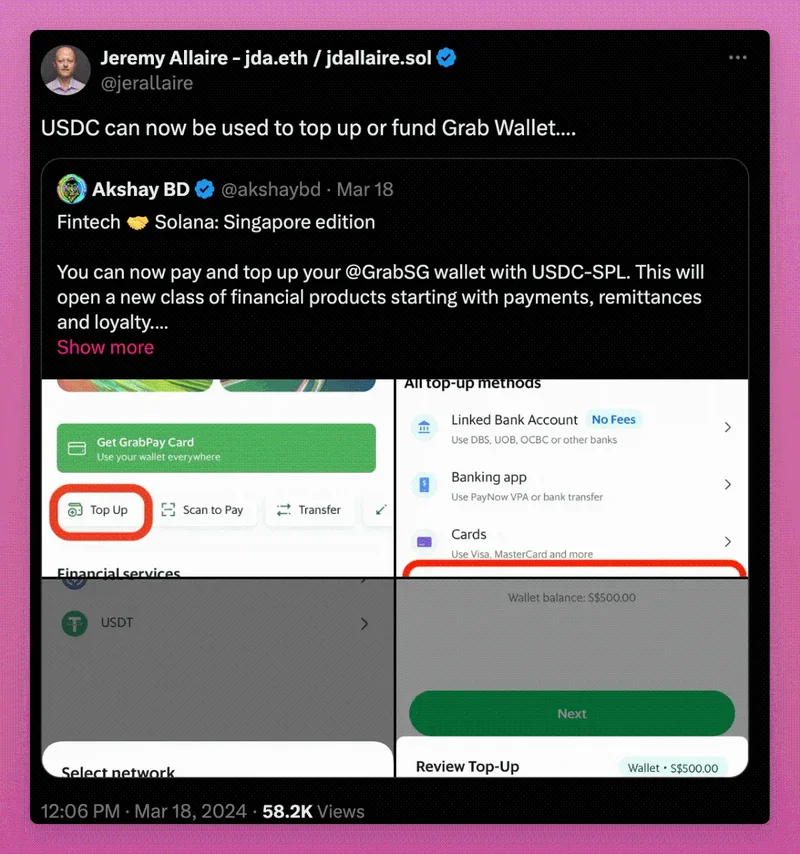

More importantly, the super app Grab, commonly used for ride-hailing, food delivery, and other services, has started allowing users to top up their e-wallets using cryptocurrency. Now, users can pay with Bitcoin, Ethereum, XSGD (Singapore's local stablecoin), Circle USD, and Tether.

In the second quarter of 2024, cryptocurrency payments for merchant services in Singapore reached nearly $1 billion, setting a two-year record.

This is an interesting shift, especially in a market where traditional payment systems are already efficient, indicating that cryptocurrency is gradually becoming a common asset for more people.

Meanwhile, over 75% of the transfer amounts for XSGD are $1 million or less, with nearly 25% of transfers being under $10,000, clearly indicating that the retail user base in the local crypto market is growing.

The success is attributed to clear regulations, which have enhanced trust in stablecoins.

In 2023, the Monetary Authority of Singapore (MAS) established guidelines for stablecoins, and in 2024, it launched rules for cryptocurrency custody and licensing.

This demonstrates the positive impact that clear regulations can have on cryptocurrency adoption in the U.S.

Case Study: TON's Successful Entry into the South Asian Market

TON's play-to-earn games have gained significant popularity in South Asia, which is quite surprising. Personally, I have tried them, but the rewards didn't seem worthwhile to me.

You might underestimate TON because of the oversaturation of airdrops and “mindless” click-to-earn games, but it actually aligns with their goal of bringing cryptocurrency into everyone's pockets.

By receiving free tokens, a new wave of users can start learning how to trade on decentralized exchanges (DEX), add liquidity, stake, and gradually explore other aspects of the ecosystem.

Do you know where these users mainly come from? CIS countries and South Asia.

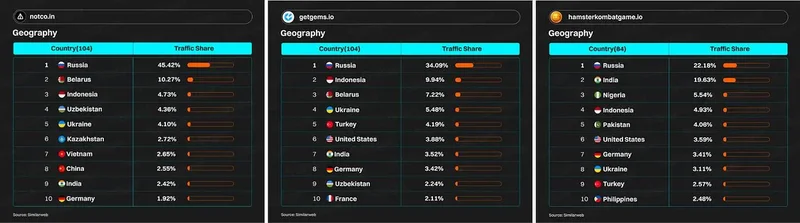

Notcoin's website (notco.in) sees over 66% of its traffic from CIS countries, followed by Asian nations like Indonesia, Vietnam, China, and India. Getgems.io and Hamster Kombat show similar trends, consistent with the Telegram user base.

The Telegram Mini Bot projects that offer free tokens resemble the rise of Axie Infinity in the Philippines.

The success of the TON blockchain boils down to two high-adoption areas: free airdrops and click-to-earn games.

Free Airdrop Space

Everyone is tired of activities that exchange points for airdrops. This is what makes the free airdrop scene on Telegram unique. It leverages Telegram's 900 million users to distribute tokens like DOGS. DOGS initially gained attention as a meme due to its fair distribution and lack of pre-sale. This attracted new users to the blockchain, making DOGS distinct from typical crypto tokens.

DOGS quickly listed on major centralized exchanges (CEX) like Binance. Airdrop amounts ranged from $10 to $60 per wallet. While this may not sound substantial to many Western investors, users can accumulate rewards through multiple accounts. For many people in developing countries, these airdrops provide a new source of income amid economic hardship.

Click-to-Earn Games

Click-to-earn games like Hamster Kombat are rapidly growing in South Asian countries. Within just three months, it reached 239 million registrations, making it one of the most popular click-to-earn games.

It also gained over 10 million YouTube subscribers in just a week. That's insane! These are unprecedented numbers in many Western countries.

According to Bitget Premarket data, the total market capitalization of its token is $920 million, indicating that the value of the airdrops could be around $550 million.

Thanks to simple game mechanics, referral campaigns, and positive social influence, click-to-earn games like Hamster Kombat have rapidly attracted significant attention among cryptocurrency influencers in Southeast Asia.

These influencers are also very popular on TikTok and X, sharing referral links and spreading information about this type of game.

Conclusion

South Asia and Southeast Asia are among the most populous regions in the world, with a young and tech-savvy demographic, making them key markets for cryptocurrency businesses. It is now the third most important market after the United States and Western Europe.

However, due to significant differences in income, government regulations, and economic conditions among countries in the region, it can be challenging for businesses to formulate appropriate strategies for each country.

TON appears to be executing well on strategies targeting the speculative market, and the acceptance of crypto payments is steadily rising.

FAQ

Q:

A:

Related Articles

What is SparkLend? A Beginner-to-Advanced Guide to Decentralized Lending Made Easy

SparkLend is a decentralized, non-custodial liquidity market protocol built on the Ethereum blockchain. Simply put, it functions like a bank without intermediaries, allowing users to borrow and lend d

June 26, 2025

What is sUSDS? How Do I Acquire sUSDS?

This guide will walk you through Sky Savings’ sUSDS and sUSDC—your gateway to earning yield with stablecoins while keeping your funds secure.Sky Savings: Your Journey to Stablecoin Yields Begins HereW

June 26, 2025

What is SparkLend? A Complete Guide from Beginner to Pro

SparkLend is a decentralized, non-custodial liquidity market protocol that allows users to participate as lenders or borrowers. Lenders provide liquidity to earn passive income, while borrowers can ta

June 24, 2025

What Exactly Does Spark Protocol Do? A Complete Guide

This guide will walk you through Spark Protocol — an innovative platform designed to tackle the long-standing issue of fragmented liquidity in the DeFi space. You'll learn how to earn yield, borrow as

June 24, 2025

RXS Token Trading Guide: From Presale to Uniswap – A Complete Walkthrough

This guide will walk you through the trading process of the RXS Token, from the restrictions during the presale phase to free trading on Uniswap, helping you trade securely and efficiently.1. Introduc

June 24, 2025