As the 2024 U.S. presidential election approaches, examining the historical impact of elections on Bitcoin prices becomes increasingly important. Stock market performance during elections often reveals patterns, and the relationship between Bitcoin and traditional financial markets provides valuable insights.

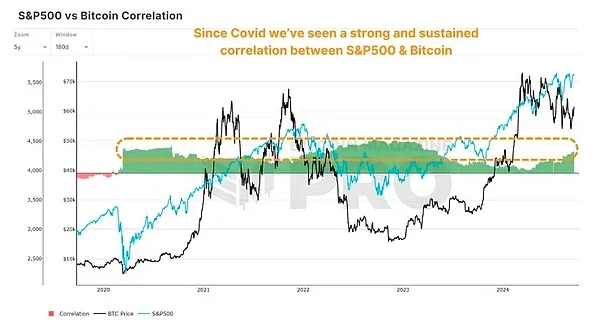

Correlation Between Bitcoin and the S&P 500

The strong correlation between Bitcoin and the S&P 500 is evident across multiple market cycles, especially during Bitcoin bull markets and times of high market risk appetite. Although Bitcoin is gradually being viewed as an independent asset with volatility and investment characteristics distinct from the stock market, it's still uncertain whether this "decoupling" trend will persist long-term. Bitcoin's price is often influenced by macroeconomic factors and market sentiment, keeping its movements closely tied to traditional markets.

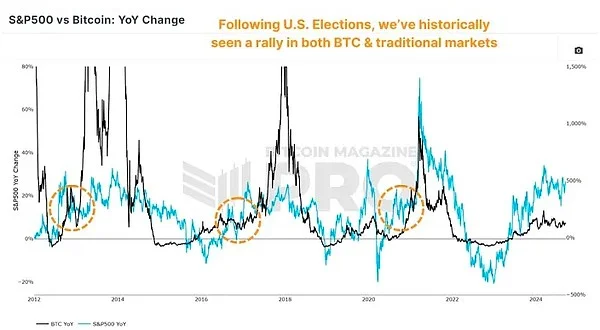

Market Reactions Post-Election

Historical data shows that the S&P 500 typically performs strongly after U.S. presidential elections. This trend suggests that election outcomes eliminate uncertainty and restore investor confidence. Market returns following recent elections reflect this:

- 2012 Election: The S&P 500 increased by 32% in the year following the election.

- 2016 Election: The index had a return of about 22% post-election.

- 2020 Election: The S&P 500 saw nearly a 29% increase afterward.

Additionally, the performance of other asset classes, like gold and bonds, post-election is noteworthy. Gold, often seen as a safe-haven asset, tends to remain stable but may be sold off after elections due to rising risk appetite, underperforming compared to Bitcoin.

Macroeconomic Factors

Election results directly influence economic policies, including taxation, monetary policy, and regulatory frameworks. For instance, if a new government adopts an accommodative monetary policy, it could increase market liquidity, pushing up risk assets like Bitcoin. Conversely, a tightening policy could dampen market enthusiasm, leading to a decline in Bitcoin prices.

Investor Sentiment

The impact of election outcomes on investor sentiment is significant, with polls and results often causing sharp market fluctuations. Optimistic election results may encourage increased investment in Bitcoin, while pessimistic expectations could trigger market sell-offs. When this sentiment translates into market behavior, it often creates strong buy or sell signals.

Technical Analysis

Technical analysis plays a crucial role in predicting Bitcoin price movements. Key indicators such as moving averages (MA) and the relative strength index (RSI) can provide references for price trends. For example, if Bitcoin's price breaks through a significant technical resistance level, it may trigger more buy signals, driving prices higher.

Risk Factors

Despite historical trends indicating that Bitcoin typically performs well post-election, potential risk factors must be considered. Policy changes, market bubbles, and global economic uncertainties could all impact Bitcoin's performance. For instance, if a new government implements stringent cryptocurrency regulations, it could lead to market panic and suppress prices.

Comparative Analysis with Other Cryptocurrencies

While assessing Bitcoin's performance, it's also essential to consider the performances of other major cryptocurrencies (such as Ethereum and Litecoin). These cryptocurrencies may experience similar market sentiments and policy influences post-election, but their technical features and market demand may lead to different price reactions.

Expert Insights

Insights from industry experts and economists provide deeper analysis. Some economists argue that every instance of economic stimulus in the past has coincided with rises in cryptocurrencies, predicting that if market liquidity strengthens post-2024 election, Bitcoin could reach new heights.

Editor’s Commentary

As the U.S. presidential election nears, historical data offers valuable insights into Bitcoin's potential performance. Although the market environment is complex and multifaceted, influencing Bitcoin prices involves various factors. Investors should assess future trends by considering macroeconomic conditions, policy changes, and market sentiment. While historical patterns may not completely repeat, investors can remain optimistic about Bitcoin's future, anticipating its post-election performance.

Related Articles

Differences between Bitcoin and Dogecoin

Bitcoin and Dogecoin are two different cryptocurrencies. Although they share some similarities, there are significant differences at their core. Bitcoin is the first cryptocurrency, designed to be a decentralized digital currency primarily used for value storage and transactions, with a total supply capped at 21 million coins.

October 10, 2024

Where is the best Bitcoin exchange?

Choosing the right Bitcoin exchange depends on several factors, including security, fees, liquidity, user experience, and legal regulations in your location. Below is a detailed analysis of some of the top global Bitcoin exchanges to help you make an informed decision.

October 10, 2024

Future Development Trends of Bitcoin: Increased Global Acceptance and Market Outlook

The future development trends of Bitcoin may focus on several aspects: as global acceptance of digital assets increases, countries will establish clear regulatory policies to promote its legalization

October 9, 2024

How to Buy Bitcoin on the Etoro App?

The most basic way to buy Bitcoin on the Etoro app is to first log into your Etoro account, then search for "BTC" or "Bitcoin" on the market page, and select the Bitcoin trading pair. Next, click the "Trade" button, enter the amount or quantity you want to purchase, set the stop loss and take profit levels (optional), and finally confirm and execute the trade. Please note that Etoro offers CFD trading rather than direct cryptocurrency purchases.

September 27, 2024

What is Fractal Bitcoin?

Fractal Bitcoin is emerging as a promising scalability solution that is gaining widespread attention. It constructs a multi-layered network structure through recursive virtualization technology, not only enhancing the scalability of Bitcoin but also ensuring a secure connection with the main network.

September 26, 2024